modified business tax nevada instructions

Right click on the form icon then select SAVE TARGET. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form.

PdfFiller allows users to edit sign fill and share all type of documents online.

. Select the document you want to sign and click Upload. Ad pdfFiller allows users to edit sign fill and share all type of documents online. If your business has taxable wages.

Ad Register and subscribe 30 day free trial to work on your state specific tax forms online. The modified business tax MBT is considered a payroll tax based on the amount of wages paid out in a quarter. The tips below can help you fill out Nevada Modified Business Tax quickly and easily.

The default dates for submission are April 30 July 31 October 31 and January 31. IRS Form 7004 3995 Now only 3495 Your State Extension Form is FREE The State of Nevada is one of seven US. Nevada modified business tax covers total gross wages amount of all wages plus any tips for each calendar quarter minus employee health care benefits paid by the business.

File electronically using Taxpayer Access Point at. However with our preconfigured web templates things get simpler. Complete the necessary fields.

If you are using Chrome Firefox or Safari do NOT open tax forms directly from your browser. Open the document in the full-fledged online editor by hitting Get form. Total gross wages are the total amount of all gross.

The preparation of lawful papers can be expensive and time-ingesting. The preparing of lawful papers can be costly and time-ingesting. Follow the simple instructions below.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Follow the simple instructions below. Identify and categorize the type of industry for your business.

Select the type of business you want to register. As in most states ever employer subject t the states unemployment compensation law is subject to a Modified. Forms and payments must be mailed to the address below.

Fast Easy Secure. Follow the step-by-step instructions below to design your nevada modified business tax form. Nevada Modified Business Tax Rate.

The modified business tax covers total gross wages less employee health care benefits paid by the employer. Nevada Modified Business Tax Rate. However with our predesigned web templates things get simpler.

Understanding the Nevada Modified Business Return and Tax Form. States that does not impose a state income tax on business. Nevada Department of Taxation PO Box 7165.

Edit Fill eSign PDF Documents Online. Modified Business Tax.

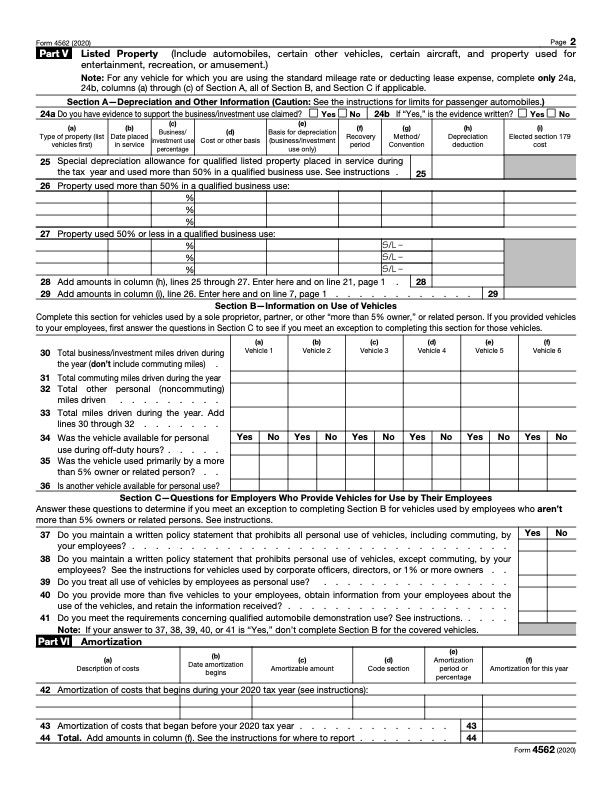

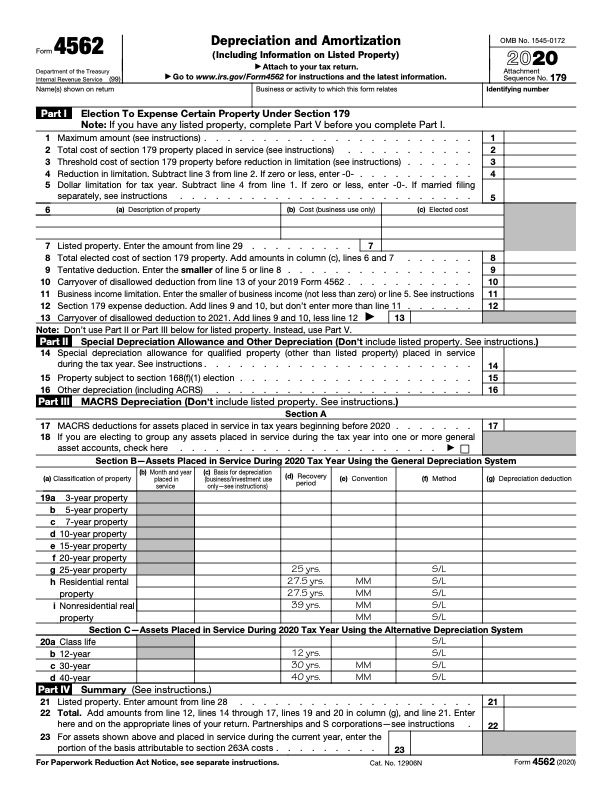

How To Complete Form 1120s Schedule K 1 With Sample

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

How To Complete Form 1120s Schedule K 1 With Sample

/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Tax Planning Strategies Tips Steps Resources For Planning Maryville Online

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)